Con bishop steals billions from Ugandans

Ephren Taylor, 32 the Ponzi Perpetrator at Eddie Long, Joel Osteen Churches Heads to Prison

https://watchmanafrica.blogspot.com/2015/03/ephren-taylor-32-ponzi-perpetrator-at.html

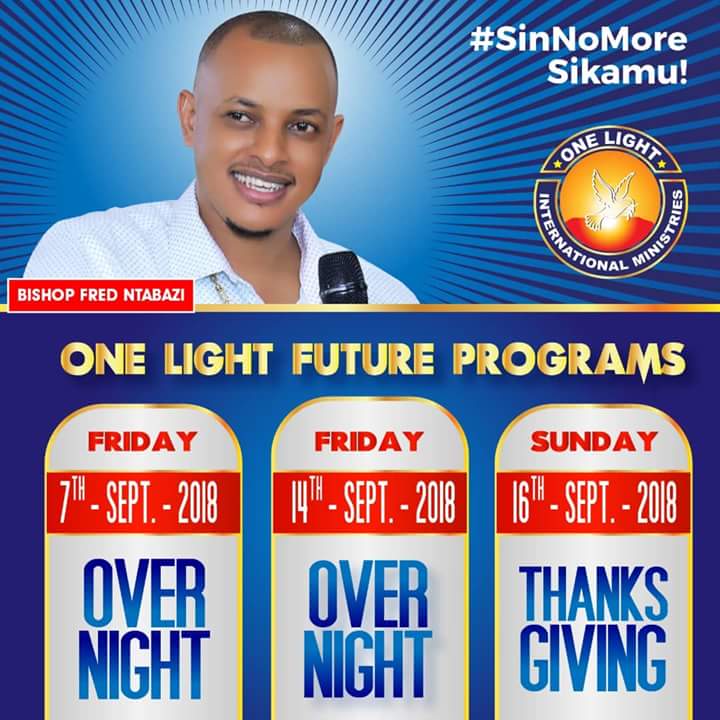

Fred Ntabazi, who calls himself bishop, is a short man with a fair complexion and round eyes, which are seemingly kind, gentle and inviting. Some would not be faulted if they thought him cute. He had the trimmings of a man of God: a smooth voice, gentle eyes, down-to-earth attitude and Godly salutations. He would walk into his office greeting everyone with a smile, saying, “Mukama waffe yebazibwe” [Let us be thankful to our Lord].

Little did they know that underneath it all was a conman, a fraudster, who was smiling his way to amass billions from rich, fair earners and poor Ugandans that entrusted him with their money to invest in forex trading with his company, Pio Crypto Center Investment Limited.

His proposal was simple: invest a minimum of Shs 5m and, after a fortnight, get 10% [Shs 500, 000] every week for the next 48 weeks. This meant that an investor of Shs 5m would make Shs 24m after 48 weeks, and not many Ugandans would say no to that. Drawn to the prospect of prosperity, a chance to rise from the ditch of poverty, many were ensnared by his scheme.

Some borrowed from banks, saving schemes and loan sharks, and others sold assets: land, cars and houses to invest in forex trading. Ntabazi had a calculated method that guaranteed his fraudulent success. He assigned agents, who cleverly picked their marks [read victims] with the promise of 10% weekly deposits from the lucrative forex trading.

The agents started convincing people within their circles first, and urged them to get more people to invest in the scheme so as to spread prosperity to all their loved ones, colleagues and neighbours. And that’s exactly what the unsuspecting marks did, especially after receiving the promised weekly 10% deposits on their bank accounts, mobile money or even physically picking the money on either Friday or Saturday.

This went on until December 7, 2019 for some and December 14th when the weekly deposits came to an abrupt end. But earlier in November 2019 the, Internal Security Organisation had arrested Andrew Kaggwa, the chief executive officer of Global Cryptocurrencies Limited, for fleecing victims of money to the tune of Shs 15 billion.

When this news broke, Ntabazi’s stalwarts assured his victims that it would never happen to them because their business was legitimate. Ntabazi himself told concerned investors, who ran to his office to inquire about the safety of their investment, that all was well because he had connections to State House. He said, “Ndi wamunju,” to mean, “No one can touch me because I am related to State House.”

Little did the marks know that December 14, 2019 was the last time they would receive deposits on their accounts. Even then, on December 14, Ntabazi called for a meeting with investors at his offices to explain how the banks were against them. That, he said, explains why there was a glitch in making the deposits. He said banks were jealous that people were making money through forex trading and cryptocurrency.

He then assured his investors that after sorting the issue with the banks, payments would resume on December 21. Ntabazi, who was good at buying time, then explained that the forex trading system had slowed down during the Christmas festive season and business would resume on January 11, 2020.

At that point the investors still had hope in the smooth-talking ‘bishop’, who assured them that he wasn’t running away and that the offices were still open, which showed that he was genuine. Come January 11 and another set of lies spewed from his convincing mouth and it was the same line he had previously used, but with a different meaning. “Ndi wamunju,” he said, but this time he meant that no one could touch him in a sense that no one can bring him to book.

The incensed investors, who had gathered to get an explanation as to why their accounts had not been credited, charged, saying, “We are going to sue you.” To which Ntabazi replied, “Go ahead, no one can touch me.”

It was quite shocking to see the veil lifted from his sweet face to reveal the menacing fraudster that Ntabazi actually is. His investors shook their heads in disbelief when Ntabazi exited the room and this time he didn’t have his godly, warm smile, but a sneer.

True to his method of managing investors, Ntabazi’s agents were deployed, but this time to manage their marks. So, the marks kept calling and WhatsApping the agents for any news, a sign that all will be well; and the agents played their part, assuring them that the system will return to normal at the end of January when stock markets were back to full operation.

January 30 came and more lies came out. “You will get your money on February 15th,” reported the agents to their marks. Excitedly, one young woman exclaimed that that would be the best Valentine’s gift she would have ever received if the money was deposited on February 15.

Ntabazi and his fraudulent crew were really cunning and devised a way to give people hope, but not money. He said since the banks, and later the government, did not want people to have money, they were frustrating the payment process onto people’s accounts. He then said he had started a Sacco, Kampala Digital Financial Commodities Traders Cooperative Society Limited (KDFC) so that investors transfer their money to the Sacco because the laws of Uganda were a little relaxed on Sacco operations.

Some marks followed his advice and transferred their accounts to the Sacco, which meant that they could no longer demand for their 10% weekly deposits because they had collapsed that agreement in favour of the Sacco.

February came and went, and the promise of payment was deferred to the end of March for those that did not agree to joining the Sacco. Unfortunately, that is when the global pandemic, COVID-19, struck and everything was at a standstill. For Ntabazi, this was a blessing in disguise because he got the breather he wanted from investors.

As March turned into April, May, June, July and now August, the marks are still waiting for justice, for Ntabazi to return their money. Some ran to the police and registered complaints against him, but the police said it was hard to arrest him in the lockdown.

Others sought refuge at the Anti-Corruption Unit, under State House, but Lt Col Edith Nakalema sent them away, saying the office had more than enough cases and it was not taking on any news cases.

Ntabazi’s curse

For this article, I was unable to reach Ntabazi because his phone was off. But much as he may dodge calls, his victims hope he won’t be able to escape the law, and most especially, God’s vengeance because some were duped for trusting the man of God, who would bless them with oil when they dropped by his office. His church, One Light International Ministries, was situated on the fifth floor of Padre Pio Building too.

As they look to God to punish the man and his agents for using His name to lure them, the victims also pray the law of the land will rein him in and return their precious savings.

FAKE BISHOP FORMS PONZI SCHEME TO ROB GULLIBLE UGANDANS

Are crypto-currencies in Uganda another Ponzi-scheme?

-