One of the Victims who lost over 200 million in the Scam

MUST READ

Greed is Good, Greed is right, greed works: How thousands including UPDF general were fleeced of billions in cryptocurrency neo-liberal scam

https://watchmanafrica.blogspot.com/2020/08/greed-is-good-greed-is-right-greed.html

When Neo-liberal Thug pastors with security detail Rob Ugandans with impunity: Slay Prosperity Bishop FRED NTABAZI of ONE LIGHT INTERNATIONAL MINISTRIES cons Ugandans of Millions in Ponzi Scheme

https://watchmanafrica.blogspot.com/2020/08/when-neo-liberal-thug-pastors-with.html

Ephren Taylor, 32 the Ponzi Perpetrator at Eddie Long, Joel Osteen Churches Heads to Prison

Ponzi schemes in Uganda are part and parcel of the government’s Plan to promote economic development through Primitive Wealth Accumulation : Why Museveni’s Neo-liberal banditry state pretends to Sympathize with the Victims of Ponzi Schemes

https://watchmanafrica.blogspot.com/2020/08/ponzi-schemes-in-uganda-are-part-and.htmlHow thousands including UPDF general were fleeced of billions in cryptocurrency scam

Thousands of Ugandans including senior army officers are counting losses after investing in what turned out to be a fake cryptocurrency initiative.

Kenneth Kazibwe December 2, 2019

Thousands of Ugandans including senior army officers are counting losses after investing in what turned out to be a fake cryptocurrency initiative.The Internal Security Organisation on Monday night arrested Andrew Kaggwa, the Chief Executive Officer for Global Cryptocurrencies Limited opening a can of complaints from clients who have been fleeced huge sums of money amounting to billions.

According to Sheila Nassali, 27,a nurse from Namugongo in 2018, Kaggwa wedded her sister and after the function, he introduced her to a company he was soon setting up that he wanted her to be part of.

Nassali says Hudson Ntende and Kaggwa were the main directors of the company who were signatories to the company documents.

She says that the company started small along Kampala road but business grew in a small time and after two months, they shifted headquarters to Lions Shopping centre along Namirembe road.

“People could deposit money between shs100,000 and 10million and after 30 working days, they could get an interest of 40%. The business kept on growing big day by day.”

“As the company grew, we were asked by the managers that we should love the work we do by investing some small money to get returns. After realizing it was genuine, we were asked to recruit our family members, relatives and villages mates to also join the budding and lucrative business,”Nakaddu begins her story.

She narrates that in the company, she was the one in charge of supervising and evaluating the works and business.

How it works

According to Nakaddu, they were asked to recruit family members who would in return also recruit other people.

The people recruited, according to victims were asked to register with the company before becoming official clients who would get paid after every 30 working days.

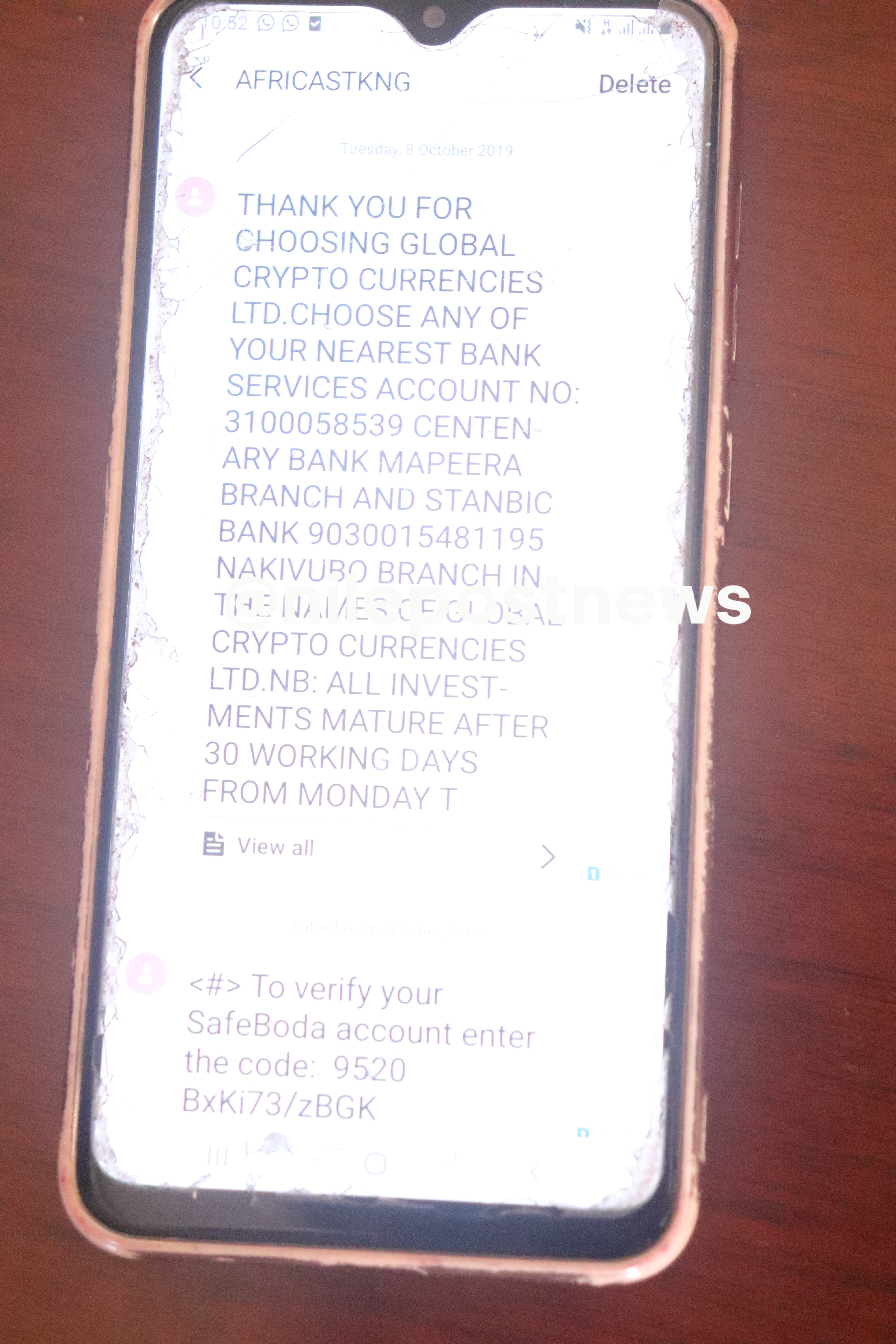

“They request you to register using either your national ID, driving permit , work ID or passport and after joining, they give you two bank accounts in Stanbic and Centenary banks where you deposit the money and when time comes to receive your interest, it is paid through your bank account,” said Annet Irankunda, a UPDF soldier attached to Bombo Military hospital as a nurse.

“When she told me about it that one gets an interest of 40% on his money, I realized it was impossible. I refused to join but it was not until when I saw her buy plots of land and vehicles out of the same that I accepted to join. I borrow shs10 million from our Wazalendo Sacco that I invested and was supposed to get interest this month,” the UPDF nurse cum soldier who refused to divulge more information about her rank for fear of reprisal from her bosses narrated to this website.

According to David Mwesigwa, a pastor at Soul Touch Healing Ministries in Bbunga, he was introduced to the initiative by Kaggwa who is one of the church members.

“He convinced me to join together with my wife and later we convinced many other church members to join,”Mwesigwa who together with the wife joined the initiative with shs2.7 million narrated.

Godfrey Walakira Kato, another pastor with a church in Kazo and Namungoona, they were tipped about the “lucrative” business by one of their followers and asked them to join.

“I first invested shs200,000 and I got profits. This encouraged me to invest in more. I then asked my followers to also invest their money,” he says.

According to Richard Kisakye who is in the treasurer at one of Kato’s churches, when they got to know of the initiative, they welcomed it with both hands and also encouraged other church members to join.

Florence Bukirwa says she was asked to recruit relatives, family members and other people both from her village in Namungoona and Mityana where she was born.

It is her that lured her father, a UPDF colonel(names withheld) into the initiative where they could get some money.

“I thought it would be bad if I didn’t alert my people to join and get themselves some money,”Bukirwa narrated.

Nakaddu Summaya says that many employees, especially in Centenary bank also joined the initiative after seeing that it was genuine.

“Whenever a client went to deposit money, they would be asked by the bank employees how the initiative was doing and on being told it was moving on well, they rushed to join. Many of them including managers, tellers and supervisors joined and were our clients,”Nakaddu said.

Things get worse

According to the victims of the scam, things were moving on well for the past one year and so until this month when they never received their money.

“When we demanded for our money, we were told there was a technical glitch but the money would be paid the next day. This never happened,” said Jane Kyomukama.

Nassali says that when she realized many clients were demanding for their money and were not being paid, she gave a call to one of the managers, Kaggwa who assured her everything would be fine in the next few days and asked her to tell customers not to worry.

Nakaddu says because she was the one clearing whoever was to be paid, she got over 500 calls over the same but his bosses had asked her to tell them that there was meeting at Pope Paul hotel in Ndeeba where all clients’ problems would be discussed and told the way forward.

“I then received a call from one of our clients who is a manager in one of the banks that our account had been blocked with shs10 billion on it. I then called Kaggwa to explain the circumstances but he pressed busy,”Nakaddu says.

“When I called Ntende, he did the same. When I called Kaggwa again, all his known phones were off. The same happened to Ntende later.”

She says that at Pope Paul, their clients converged for the meeting but had to leave at around 9pm without seeing any of the company managers.

What went wrong

Nakaddu suspects the money on the accounts for the company was withdrawn by the managers and used it for their own ventures because as time went on, the money on the account kept on reducing day by day.

“Because there was little money on the account, our clients kept on complaining because of not getting their due money.”

She says that the business had grown from paying out shs200 million a day to shs900 million a day in all the 13 branches across the country.

According to Nakaddu, the company had branches in Mukono, Kayunga, Mbale, Kyotera, Lira, Gulu, Masaka, Iganga and Mubende among other parts of the country.

Some of the victims of the scam include senior army officers, one at the rank of Maj.Gen and Colonel , nurses and Centenary bank employees among others.

Problems

According to the former employees of the company, some of whom shed tears while narrating their ordeal, the scam has created problems for them with the people they had lured into it.

“When the people I had lured into this got to know that it was a scam where they had lost a lot of money, they wanted to burn my mother. They are currently looking for me but I have not slept home for two weeks for fear of being attacked,”Nassali said as tears rolled down her cheeks.

For Florence Bukirwa says she fears going back to her home and neither can she return to her village.

“I don’t know how I am going to face the farmers in Mityana whom I persuaded to join this initiative after convincing them that it was lucrative,”Bukirwa says.

“If I knew it was a scam, I would not have joined because apart from losing trust among relatives and friends, I have lost my own money that I had invested into it.”

For David Mwesigwa, members of his church have labeled him a traitor who sold them to Kaggwa in order to fleece them of their hard earned money into a scam.

When asked why they had easily joined the initiative, the victims said they had been told by Kaggwa that his company deals in buying and selling of dollars that it makes 100% profits, thus giving us back only 40% of it.

“Because we used to get our interest, we could not easily tell that we could be fleeced. We thought it was genuine,”Mwesigwa said.

Other victims of the scam said they were told that the company deals is buying and selling of oil and that it was lucrative that the managers used the clients’ money thus paying them (clients) 40% interest.

Company manager denies

When asked why he had fleeced his clients of huge sums of money, Kaggwa who is currently in ISO detention said business didn’t go as expected.

“There is no business without shortfalls. We also experienced the same,” Andrew Kaggwa said.

“We deal is buying dollars at cheaper prices and when the price goes up, we sell them.”

He however denied that his company had fleeced his clients of huge sums of money.

ISO director, Col. Kaka Bagyenda said it is appalling that Ugandans expect to get a lot of money by putting in a business they don’t know.

“How much does the operator have that he gives away 40%,”Col.Kaka wondered.

He noted that the company targeted churches, the army and other professional bodies with big numbers of people who can recruit others.

“He targeted groups of homogenous people where there could be no leakage in order to cheat them.”

Why it was easy to fleece the victims

According to the victims the company presented itself as being professional where none of their employees touches the money you invest in but rather the work of banks.

“You pay to the bank and you are given a bank slip. The slip is taken to the company offices where you are given another receipt to acknowledge your investment. This created confidence in us that the company was genuine,” Godfrey Kato Walakira , a pastor said.

The victims also say that the company had never got any problems since it began last year, a thing that gave them assurance that everything was fine.

“We got back all the money we invested in plus the interest as promised by the company,” he said.

They also insist that they were assured the company is genuine and deals in buying and selling of dollars and other currencies that is lucrative.

“When you check the internet, you see that the business of buying and selling currencies is a genuine one and this comforted us. We were very sure what the company is doing was the best business,”Summaya Nakaddu said.

This website has learnt that the company’s accounts were blocked with sums of money not less than shs10 billion but the same had disappeared mysteriously.

Security is still looking for Hudson Ntende, the second director for the company.

Warning

In September, the finance Minister, Matia Kasaija warned Ugandans to stay away from cryptocurrencies because government does not recognize them as legal tender in Uganda.

“This is to inform the general public that: – the government of Uganda does not recognize any crypto-currency as legal tender in Uganda. The government of Uganda has not licensed any organization in Uganda to sell crypto-currencies or to facilitate the trade in crypto-currencies and so these organizations are not regulated by the government or any of its agencies,” Kasaija said.

Crypto-currencies are digital assets that are designed to effect electronic payments without the participation of a central authority or intermediary such as a Central Bank or licensed financial institution.

Crypto-currencies may therefore be bought and held for speculative purposes in the expectation that their value will rise at a future time, whereupon they could be sold for a profit.

This is the same thing that Andrew Kaggwa under his company, Global Cyrpotcurrencies Limited told his clients that it was doing but ended up fleecing Ugandans of billions of shillings they had invested into it.

According to some of the victims, the company had asked them to create dollar accounts where they invest and get interest in dollars.

“He had asked me to invest atleast $20,000 so he could construct a cryptocurrency website where I could earn 40% after 30 working days. I had not yet got the money to invest,” David Mwesigwa, a pastor with a church in Bbunga.

The 18 pyramid schemes that have fleeced Ugandans of billions

Kenneth Kazibwe May 15, 2019

A report released this month has indicated that a total of 18 ponzi and pyramid schemes have fleeced Ugandans of billions of shillings.A report by the Financial Intelligence Authority to the Clerk to Parliament has named 18 pyramid schemes and how they have defrauded Ugandans in the past 15 years.

World Global Mobile Network

According to the report, the pyramid scheme that operated in 2012 used Mobile Network Technology via voice over internet protocol technology like Skype to market its membership strategy and was introduced in Uganda by one Stephen Asiimwe.

“It required affiliates to purchase a package and have access to global mobile network simcard which could allow you make calls and SMSs,” says the report signed by Financial Intelligence Authority Executive Director Sydney Asubo.

The report indicates that promoters of the scheme were promised payment each time they made calls or send messages and when they recruited friends and families, they could make more money each time their recruits made calls or sent messages.

The scheme according to the investigation took advantage of the fact that communication using phones is a necessity in people’s lives and therefore claimed to be sharing their profits with their affiliates.

Telex Free

This was the most popular Ponzi scheme that operated in Uganda in 2013 and fleeced many Ugandans of huge sums of money.

It was a multi- level internet marketing scheme which had and start placing one advert per day on free classified sites as the company paid you $20 per week.

“Or you could purchase the family pack for $1375 which allowed you to place five adverts per day and earn $100 per week.”

Promoters would not receive commissions on that product but instead they would pay in dollars so as to place dollars but the scheme eventually collapsed without compensating promoters.

Over shs7 billion injected in by promoters was lost when the scheme collapsed.

Adfast Inc

Also operating as Tesco trader, United HYIP League, Massive Ads and Bank Electro these also operated in 2013 and the promoters made them to appear as companies registered in the United Kingdom yet 90% of their traffic was in Uganda.

Under these schemes, affiliates are required to pay a specific amount of money for membership and are promised a guaranteed fixed return on investment.

The startup capital minimum for each of these was shs780,000 at Silver level paying a weekly fixed income of shs81,900 all the way up to the diamond level where investors would contribute up to shs31,200,000 and receive a weekly fixed income of shs4,680,000.

The promoters would then receive these funds through their back office as e-money but could only withdraw by paying for those who are joining.

“Without anyone joining, withdraw of funds was impossible.”

There were several complaints by members for failure to withdraw their accumulated e- money and the administrators shut down the websites leading to collapse of the schemes.

Two people including Rogers Byamukama and Ronald Muramuzi were behind the schemes but the latter was arrested and charged with cyber fraud.

One Thor

After the closure of Telex Free based in Brazil, one of its lead promoters Misael Martin created One Thor where he claimed to offer a clear set or four primary product categories.

These included digital electronics, wellness (vital branded food supplements), wish energy drink and digital advertising.

Just like with Telex Free, promoters were promised commission for advertising products they had first purchased for either $350 for individuals and $1500 for the family package.

The promoters were to be paid a weekly promotion commission but the scheme collapsed and Ugandans lost over shs2 billion.

Amazon traders

This scheme claimed to be a technology driven financial services corporation that delivered value to its clients by investing in cutting –edge technological solutions.

The company lured the public into its net by asking them to invest money starting at junior level of between $50 to $200 up to director level of between $5000 and $20000 with promise of reaping big through daily returns of between one percent to 1.9% depending on how much one had paid for 52 weeks.

Despite claiming to be a European company, Alexa rankings showed that over 80% of the website’s traffic was coming from Uganda, a clear indication that its administrators were from Uganda.

The report by Financial Intelligence Authority also talks of other Ponzi and pyramid schemes including; World Ventures, Viral Angels, Prosperity club, Global finance, D9 Club, One Coin, DAG Coin, First Coin, Bux Coin and Alliance in Motion.

Warning

The Financial Intelligence Authority says that despite warnings by the Bank of Uganda to the public against the pyramid and Ponzi schemes, many Ugandans have continued to embrace them and have fallen prey.

Parliament last month asked government to ban all Ponzi and pyramid schemes operating in the country accusing them of fleecing Ugandans of huge sums of money.

This followed a statement by the central bank in which the pyramid schemes were described as “fraudulent investing scams” that promised high rates of return with little risk to investors.

Last year, over 3,000 people, including senior police officers lost huge sums of money they had deposited in Global Finance, a pyramid scheme after it closed unceremoniously.

Its directors went into hiding after asking members to invest a minimum of Shs4.5 million in the scheme with a promise of 15 percent interest per month.

MPs blame rise in fraud on cryptocurrency

February 5, 2020

Legislators have attributed the increase in fraud on the mushrooming ponzi and pyramid schemes, and the rise in cryptocurrency.

This was after the State Minister of Finance, Hon David Bahati told Parliament sitting on 04 February 2020 that government has established an Expert National Task Force on Fourth lndustrial Revolution to explore the issue of cryptocurrencies and provide proposals on its application in Uganda.

“The Taskforce will also consider global trends with a focus on developments and aspirations for Uganda and the East African region.” he said.

Bahati said that advertisements will be placed in the newspapers discouraging Ugandans from investing in ponzi and pyramid schemes.

“We are also discussing with the Internal Affairs Ministry to ban such schemes. The challenge is that operators of such schemes register as financial institutions but when they get on the ground, their operations are different,” Bahati said.

The Minister admitted that ponzi and pyramid schemes involve dishonest investors taking advantage of innocent individuals by encouraging them to invest their savings into ventures that have no underlying product with a promise of extraordinary returns.

“We have continued to advise the public to desist from investing in cryptocurrencies since they are yet to be supervised and regulated in Uganda. We have therefore, strongly encouraged the members of the public to do their business transactions with only licensed financial institutions,” Bahati added.

Bahati outlined gov’t actions against the schemes

He revealed that the Ministry of Justice and Constitutional Affairs was in the process of amending the Penal Code Act to criminalise ponzi and pyramid schemes and that the Uganda Registration Services Bureau will soon adopt clear guidelines to determine beneficial ownership of companies during registration.

“The Second Schedule of the Anti-Money Laundering Act, 2013 is also being amended to include virtual assets providers on the list of accountable persons,” he said adding that, ‘this will bring virtual assets service providers including providers of cryptocurrencies to be brought under the purview of the Financial Intelligence Authority and will be required to adhere to reporting requirements under the Act”.

Hon Mwine Mpaka (NRM, Youth Western) who moved a motion in 2018 calling for a ban on such schemes however, accused government of protecting those involved in the business.

“The Financial Intelligence Authority submitted a list of all companies involved in this fraudulent business and the Ministry of Finance knows them but they are quiet. I know of a bishop who is involved in this business and he is heavily guarded,” he said.

Hon. Jovah Kamateeka (NRM, Mitooma district) called for increased sensitisation of the public about the dangers of investing in such schemes.

“We need to encourage our children to value hard work because some university students have also been duped. You do not put money into a computer and think you will earn too much,” she said.

The Speaker, Rebecca Kadaga questioned government’s commitment towards banning such schemes saying that the issue has been raised severally but no action has been taken.

“We expected government to update Parliament on progress made in disbanding accounts of such schemes and a ban on their operations,” she said.

Kadaga directed government to update the House on the progress made on sensitizing the public on the dangers of investing in ponzi and pyramid schemes.

Cryptocurrency is a virtual currency in which encryption techniques, based on Block chain technology, are used to generate units of the virtual currency and verify the transfer of virtual funds.

Cryptocurrency provides for its own authenticity, validity and usage terms and conditions. lt is a decentralized peer-to-peer payment network that is powered by its users with no central authority.